Coffee Sourcing Transparency

In 2015, barismo took the step of publishing our first sourcing transparency report. We’re part of a small but – we hope – growing group of roasters who share the prices they pay for their coffees. Our reason was simple: in a market increasingly saturated with coffees dressed up in the progressive language of direct trade, it’s getting harder and harder for consumers to cut through the noise to find truly quality coffees. By giving our customers a window into our sourcing financials, we could provide concrete evidence to defend our coffees’ quality. We recognize that the coffees we serve at barismo are more expensive than those you may find around the corner. That’s because we pay more for them, too – up to three or four times the market price. Why do we pay so much? Because our coffees are sweet, clean, complex, and – we believe – worth every penny.

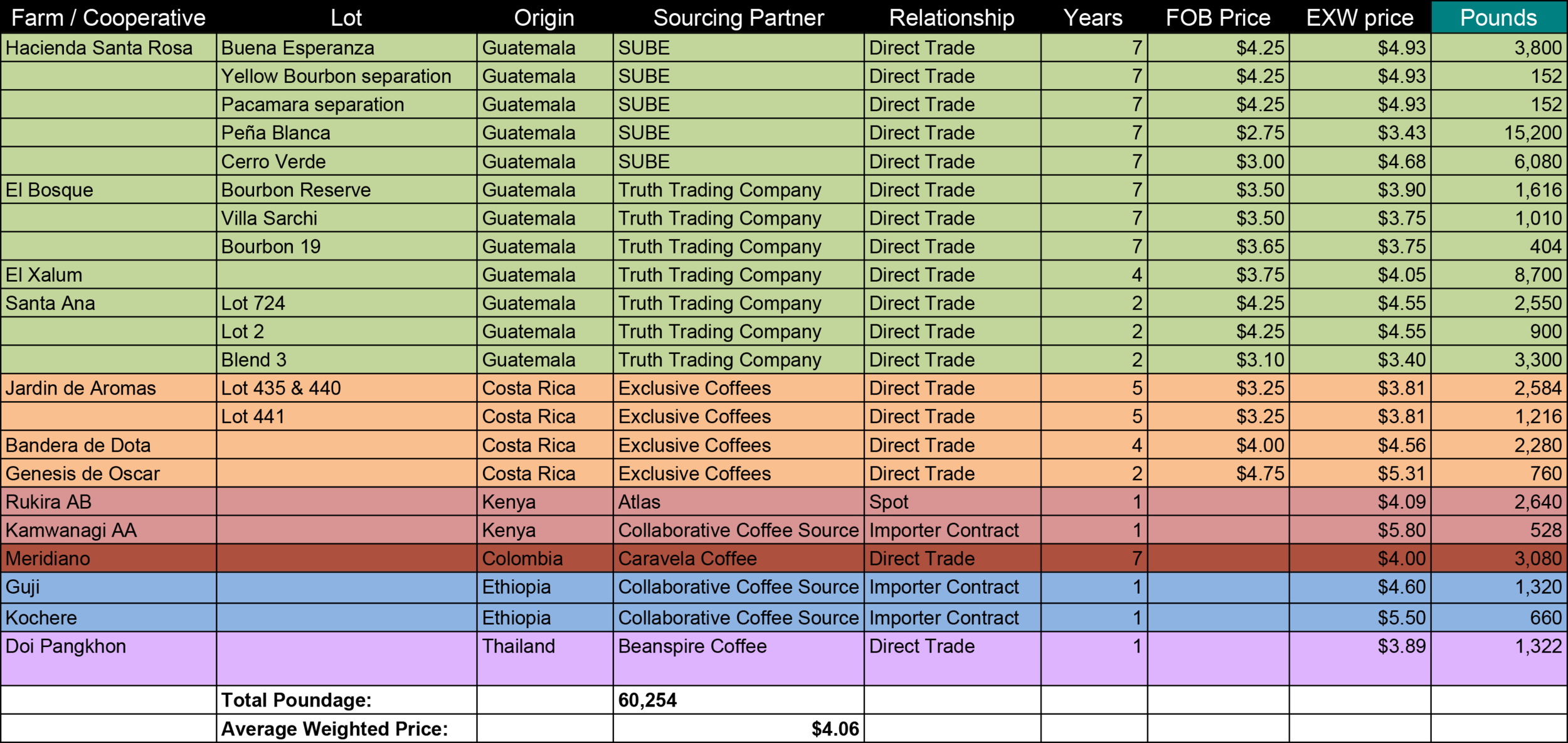

Coffee is a tough business for farmers. The market price for coffee, determined at a New York trading desk, ranges from $1.10 – 1.60 per pound – barely high enough to cover the costs of production. Even worse, the price of coffee is notoriously volatile, making it impossible for producers to budget their yearly expenses or reinvest their income in their farms and communities. By focusing on quality, producers earn access to a more lucrative segment of the coffee market. Our weighted average EXW price in 2016 was $4.06 per pound – slightly higher than our average last year, and significantly higher than the price paid to farmers selling coffee on the commodity market.

But it’s not enough to pay producers more. We need to pay them in a way that rewards the concrete steps they take to make their coffees so delicious. The kind of quality we look for does not emerge from thin air; it’s the result of specific processes, well-maintained equipment, and careful experimentation. Producers have to employ the most careful pickers who are willing to harvest only perfectly ripe cherries. They have to separate lots by harvest date, by area of the farm, and by varietal, and process each selection individually. Producers must reserve time well in advance at the best dry mills in the area, so that their coffees are screened and sorted to maximize quality. All of these things cost time and money, and the price we pay must reflect those efforts.

Price, though, doesn’t tell the whole story. Sourcing is more than showing up at origin, choosing the best coffees, and offering the highest price. For us, sourcing is about building relationships that will last over the long-term. That’s in everyone’s best interest: we can satisfy our customers who eagerly await their favorite coffee’s return to the retail shelves, and producers can breathe easy knowing that barismo will continue to be there year after year.

That’s why, in this year’s transparency report, we’ve added a couple new data points. First, we want you to know how many years we’ve been buying each coffee. We’re proud that many of our relationships are six, seven, eight years in the making. These relationships are special -- we trust farmers to strive for the best coffee quality possible with an eye towards innovation, and they trust us not to jump ship if unusual weather patterns or other unforeseen circumstances make for a difficult harvest season.

Second, we’ve listed the names of sourcing partners who help us bring each coffee to you. While every sourcing relationship is different, suffice it to say that the term “direct trade” never really captures the whole messy picture. Direct trade doesn’t mean a simple transaction between grower and roaster. It means a complicated network of millers, cuppers, exporters and importers, all dedicated to the same principles of transparency and traceability in coffee. The people we work with all over the globe work tirelessly to bring you quality coffees, and we want to highlight their crucial role.

But of course, data points in a table – even if abundant! – can’t tell the whole story, either. So ask us! Ask about the story behind your favorite coffee. Ask what excites us about what that producer is planning for next year’s crop. We’re proud to offer our producers high prices for high quality, and we’re proud to serve customers who hold us accountable. We publish our sourcing financials so that you can connect the dots between what we pay at origin and what you pay in the café, and draw your own conclusions. Take a look at the prices we pay, ask us to fill in the details, and then decide what quality is worth to you. We think you'll find that our coffees are worth it.

Notable Changes:

Hacienda Santa Rosa: This is our largest, best established sourcing relationship. Our FOB price has remained stable since the prior harvest. Due to bureaucratic hurdles, we had to change our shipping plan for the coffee, resulting in an increased EXW price. On some of the lots we will be carrying for longer periods, we built in lengthy carry terms, resulting in much bigger differentials between FOB and EXW.

El Bosque: The cost on these coffees came down slightly due to processing changes; we were unable to have the coffee dried on raised beds, so instead it was dried on the patio, which is less expensive.

El Xalum: This year Christian, who runs El Xalum, began to export his own coffee via his emerging export company, Truth Trading Co. As a result, we paid slightly less FOB, but Christian made more money on the coffee overall in the end (a win/win).

Glossary of Terms

Farm/Cooperative: This is the farm or cooperative that the coffee is from. In some cases, like with coffees from Ethiopia, we've had to use a regional designation due to limited traceability.

Lot: A lot is a more specific designation for a coffee; some lots are based on a specific plot within a farm (like Buena Esperanza), or they can be based on variety, processing method, or other criteria.

Sourcing Partner: Coffee sourcing, even when done direct, means working with on-the-ground partners beyond the farmer. These are the people who help arrange export, provide ongoing QC support, or other services that make these coffees possible. This isn't a conclusive list of partners, but we do want to acknowledge some of the significant players.

Relationship & Years: How we source the coffee. When we list "direct trade", it means we have had significant involvement at the farm and mill level. Importer Contract coffees are coffees that we make arrangements with an importer to source ahead of a harvest season, and they go find a particular coffee that fits our needs. Spot coffee is coffee we have purchased from an importers list that is already arrived in the U.S., and waiting in warehouse for any interested buyer. "Years" indicates how long we have been purchasing a coffee from a particular farm or mill.

FOB: "Free on Board" cost, the cost that we have negotiated to pay for the coffee up to the point where it arrives at the port at country of origin.

EXW: "Exit Warehouse" cost, what we actually pay when we have the coffee released from warehouse in the U.S. on its final trip to us via truck freight. This reflects the cost of boat freight, financing, and all the paperwork and fees associated with importing coffee. The difference between EXW and FOB costs can vary widely based on whether or not we have built storage charges into the contract, how full the shipping container is, importer fees and other factors. Our EXW price can often be higher in practice, especially when storage charges have not been structured into the contract pricing already.

Pounds: Pounds of green (unroasted) coffee. During the roasting process, coffee will lose 15-20% of its weight.